ADVERTISEMENT

POP

See MoreCommunity

See MoreIAMC urges accountability over Bihar veil incident

Interfaith advocates condemn treatment of Muslim women after Bihar chief minister’s actions at government event.

-

The session opened with A4H Global President Pramit Makoday’s speech about American Hindu leader Saritha Komatireddy highlighting her credentials.

-

In 2024, the United Nations General Assembly declared Dec. 21 as World Meditation Day.

-

The sacrifices made by Sikh soldiers during World Wars I and II as part of the British Army are increasingly...

ADVERTISEMENT

Videos

View AllOpinion

See MorePeople

See MoreShankar Mahalingam to retire as UA’s engineering dean

Mahalingam led the College of Engineering through growth in research funding, enrollment and graduation outcomes during his tenure.

-

Abraham, a child-prodigy, is a student of Doctor of Music at Indiana University's Jacobs School of Music at the age...

-

She has been recognized for a capstone project that developed product-growth analytics for an AI ed-tech startup.

-

Indian-Australian researcher honored for early-career AI work aligned with Australia’s national intelligence priorities.

ADVERTISEMENT

Entertainment

See More

A source close to the film shared, “After ‘The Family Man’ and ‘Citadel,’ Samantha wanted to challenge herself further.

-

Third Degree Burnout – A Survivor’s Guide is a 102-minute documentary that explores burnout as both a personal crisis and...

-

As the curtains fall on 2025, the industry pauses to remember those who took their final bow.

-

Recently, actress Ananya Panday, who had appeared on KBC for...

-

The children’s content platform expands its original slate with new...

-

ADVERTISEMENT

Immigration

See More

The change by the State Department to expand mandatory online presence reviews came as hundreds of families had long-scheduled visa appointments aligned with year-end travel.

-

The Justice Department under Trump alleged the law was impeding its ability to address a "crisis of illegal immigration" and...

-

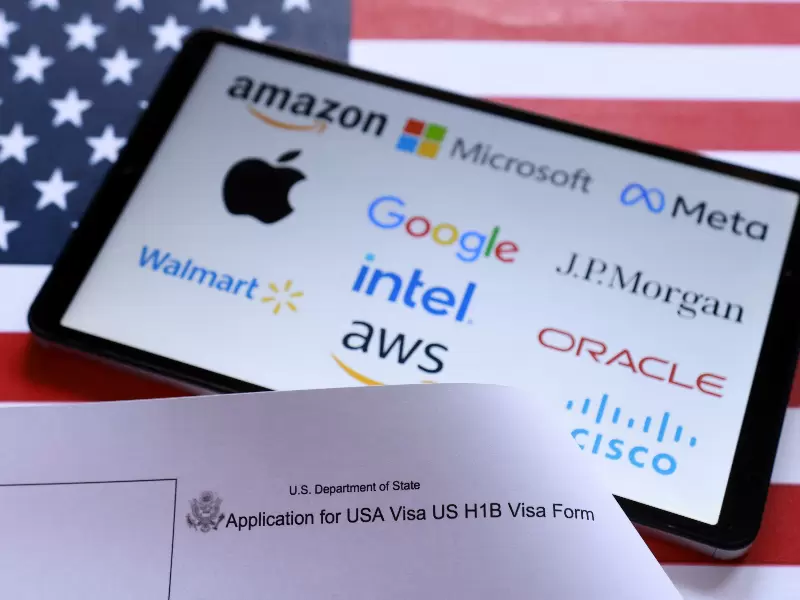

Supporters of reform have said changes such as weighted selection are necessary to restore credibility to the H-1B program.

-

As many as 110 Congressmen and 17 Senators, in a...

-

Trump's order would sharply raise the cost of obtaining H-1B...

Food

See More-

Instagram content creator Anushk Sharma shared a heartfelt review of the Michelin starred Indian restaurant in Chicago.

-

The menu draws from Lucknow’s narrow lanes, Delhi’s Mughal-era durbars, Hyderabad’s Nizami kitchens and the coastal food cultures of Tamil...

-

ADF Foods is a fourth-generation family-owned leader in gourmet frozen

-

The fast-casual Indian chain expands with a growing U.S. footprint...

-

The rebranded restaurant features team-themed visuals and a stadium-style atmosphere...

-

Attendees will receive a tour of the kitchen, observe operational...

-

Onset of illness occurred between Nov. 28 and 29, with...

-

The restaurant holds a 4.8 rating from more than 10,000...

SPORTS NEWS

See MoreSuryavanshi's century off 36 balls was the second-fastest hundred by...

Playing against an Australian Universities' team, the Indian side secured...

The win provides perfect build-up in India's quest to retain...

The Indian duo avenged their defeat to the Malaysians at...

News

See More-

ADVERTISEMENT

Please enter something

- Asian Americans

- Biz

- Books

- Canada

- Community

- Culture

- Dating

- Diplomacy

- Diwali

- Editor picks

- Editorial

- Explainers

- Fashion

- Features

- Food

- Immigration

- India

- India Decides '24

- India Independence Day

- Letters to the Editor

- Life

- Maha Kumbh

- Movies+

- News

- Opinion

- People

- Ram Mandir

- Reviews

- Sports

- Spotlight

- Tech

- Travel n’ Diplomacy

- Trump 2.0

- UK Votes 2024

- US Elections 2024

- USA

- West Coast