ADVERTISEMENT

POP

See MoreCommunity

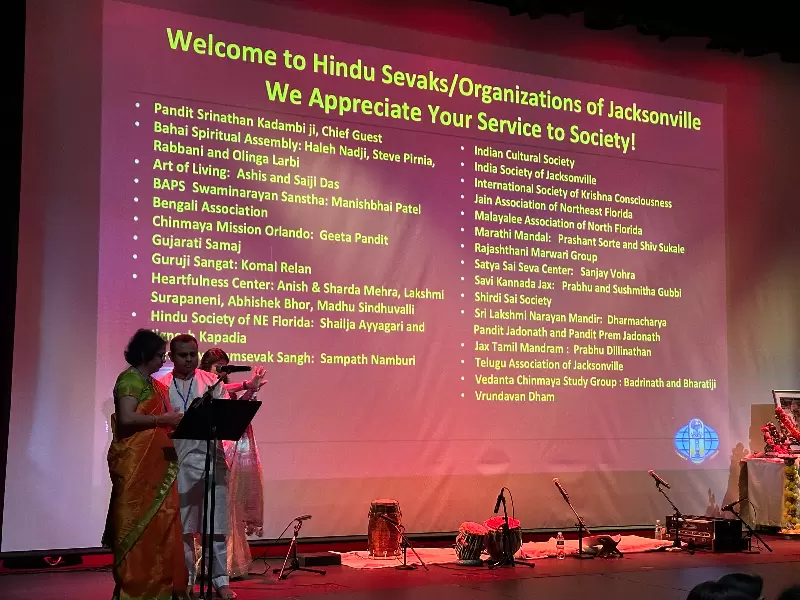

See MoreChinmaya Mission hosts 75th anniversary in Jacksonville

The event highlighted how study, youth education, and volunteer service continue to shape community life in Northeast Florida.

-

He said the festival now stands as a highlight of Australia’s cultural calendar.

-

She will be recognized for medical outreach work on March 8.

-

The Consulate will honor women leaders from diverse fields who have made impactful contributions to their professions, communities and society...

ADVERTISEMENT

Videos

View AllOpinion

See MorePeople

See MoreSaanvi Venumbaka wins Diplomacy Award in NYC

Venumbaka earned the honor for her ability to demonstrate constructive negotiation, respectful dialogue, and effective coalition-building.

-

The investor also discusses ambition, trauma and wealth in Kamath podcast interview.

-

She was recognized for research identifying gaps in the reporting and reclassification of genetic variants in clinical care.

-

VHPA leader Nirav Patel works to preserve Hindu identity, strengthen representation, and reconnect younger generations with their roots.

ADVERTISEMENT

Entertainment

See More-

The film narrates the journey of a young woman finding her footing in a world far from home.

-

Nick Jonas posted a throwback picture from one of his early Holi celebrations with Priyanka, further also giving fans a...

-

After completion, the project is expected to be submitted to...

-

She even involved her director, B. V. Nandini Reddy, in...

-

ADVERTISEMENT

Immigration

See More

Senator Eric Schmitt argued that the H-1B visa programme was increasingly being misused in ways that could disadvantage American workers.

-

Immigration and border security have long divided Congress over funding and federal versus state power and the Austin attack is...

-

Under the reforms, refugee status for adults and their accompanying children will be reviewed every 30 months.

-

The 20-year-old was flown to Honduras on Nov. 22 despite...

-

There are over 300,000 Indian students in the US, and...

Food

See More-

The Indian-origin executive will lead the company’s Snacks business, overseeing brands such as Goldfish and Pepperidge Farm.

-

The new CBS series features 16 top chefs competing for a $1 million prize in a prime-time culinary showdown.

-

The Indian-origin executive will lead the company’s Snacks business, overseeing brands such as Goldfish and Pepperidge Farm.

-

The fast-casual Indian chain recently opened its restaurant in Pennsylvania.

-

Six national prizes will recognize early-career food and media practitioners...

-

Ambassadors Clubhouse adds a fresh destination to New York City’s...

-

Doosra reimagines classic South Asian flavours with bold American twists

-

The expansion is backed by a marketplace model linking Indian...

SPORTS NEWS

See MoreHe disagreed that the Indian team is a bit too...

In Kolkata, Nitin Menon will serve as the third umpire.

With a mix of Olympic medallists, world champions, and emerging...

India's media were lavish in their praise for Samson, who...

News

See More-

ADVERTISEMENT

Please enter something

- Asian Americans

- Biz

- Books

- Canada

- Community

- Culture

- Dating

- Diplomacy

- Diwali

- Editor picks

- Editorial

- Explainers

- Fashion

- Features

- Food

- Immigration

- India

- India Decides '24

- India Independence Day

- Letters to the Editor

- Life

- Maha Kumbh

- Movies+

- News

- Opinion

- People

- Ram Mandir

- Reviews

- Rooted and Roaming

- Sports

- Spotlight

- Tech

- Travel n’ Diplomacy

- Trump 2.0

- UK Votes 2024

- US Elections 2024

- USA

- West Coast