ADVERTISEMENT

POP

See MoreCommunity

See MoreSan José marks MLK day with tree planting

The effort included mulching, weeding and other park beautification work in an underserved neighborhood.

-

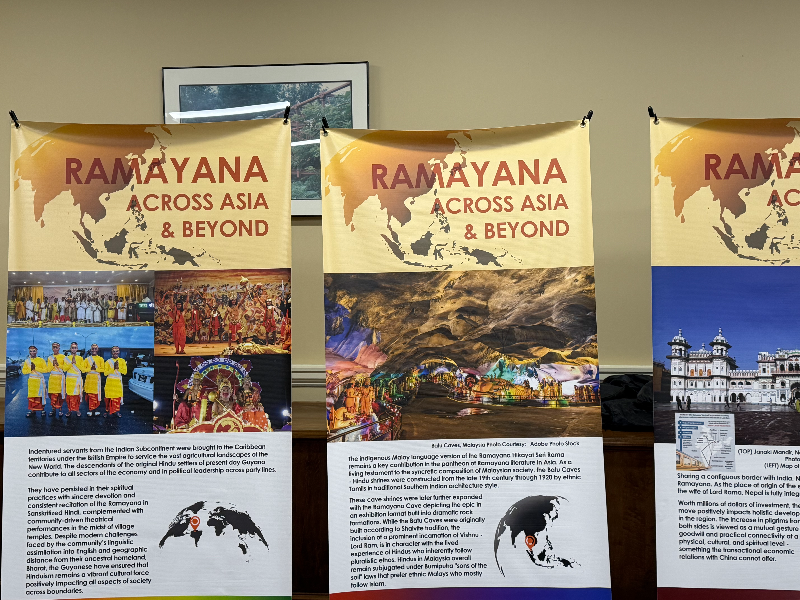

The event was designed to promote cultural exchange and global awareness at the school level.

-

The nonprofit was named among the Best Nonprofits to Work For for the third consecutive year.

-

The event sought to sensitise U.S. lawmakers and congressional staff to what activists called widespread and systemic abuses faced by...

ADVERTISEMENT

Videos

View AllOpinion

See MorePeople

See MorePrakash Maggan to chair IHG Owners Association board

He has served on the board since 2024, chaired the technology committee, and acted as vice chair of the Americas Regional Council.

-

Banerjee, a second-generation American of Indian origin, was the 2021 Boys’ Singles champion at Wimbledon.

-

Krishnan said the committee will focus on investigations into landlords, corporations, and city agencies.

-

The program is one of the world’s most prestigious scholarships that prepares young leaders to engage with China and global...

ADVERTISEMENT

Entertainment

See More-

Created and written by Gunjit Chopra, Diggi Sisodia and Sudip Sharma, Season 2 brings a fresh case

-

It's easy to remember Zeenat Aman as the glam girl in slinky gowns, but it's lazy to stop there.

-

According to the USC Viterbi School, the film has been...

-

Earlier, on the 6th anniversary of the historical epic 'Tanhaji:...

-

ADVERTISEMENT

Immigration

See More

Under federal immigration law, "applicants for admission" to the United States are subject to mandatory detention while their cases proceed in immigration courts.

-

Singh holds a California Driving licence and is allegedly in the U.S. illegally

-

Jayapal referred to the decision as ‘cruel’ and must be ‘immediately reversed.’

-

Indian travellers enjoy visa-free access across parts of Southeast Asia,...

-

"We're also going to revoke the citizenship of any naturalized...

Food

See More-

The restaurant aims to bring Italian-American classics to the Metroplex

-

The preservatives included nitrites and nitrates, which are often used to cure ham, bacon and sausages.

-

An Indian origin woman living in Canada shared her experience at the celebrity chef's New York restaurant, Bunglow.

-

Kapur attributed unhealthy outcomes largely to lifestyle choices.

-

India exported about 800 metric tons of foxnuts in 2024–25...

-

Instagram content creator Anushk Sharma shared a heartfelt review of...

-

The new Newark Avenue outlet expands South Indian dining options...

-

Chef came to Dallas on a very short visit over...

SPORTS NEWS

See MoreEarlier, Delhi built a strong foundation with the ball, led...

The BCB held talks in Dhaka at the weekend with...

Tejinder Aujla says that Kabaddi enjoys massive popularity, strong cultural...

India’s chase faltered early as Sharma, Gill, Iyer, and KL...

-

ADVERTISEMENT

News

See More-

ADVERTISEMENT

Please enter something

- Asian Americans

- Biz

- Books

- Canada

- Community

- Culture

- Dating

- Diplomacy

- Diwali

- Editor picks

- Editorial

- Explainers

- Fashion

- Features

- Food

- Immigration

- India

- India Decides '24

- India Independence Day

- Letters to the Editor

- Life

- Maha Kumbh

- Movies+

- News

- Opinion

- People

- Ram Mandir

- Reviews

- Sports

- Spotlight

- Tech

- Travel n’ Diplomacy

- Trump 2.0

- UK Votes 2024

- US Elections 2024

- USA

- West Coast