लड़खड़ाते म्यूचुअल फंड एसआईपी को क्यों बढ़ावा दे रहे हैं क्रिकेट के दिग्गज!

सरकार का कोई खर्च या योगदान नहीं। अपनी पेंशन के लिए आप ही कमाइये और आप ही बचाइये। सरकार के लिए इससे अच्छा और क्या हो सकता है।

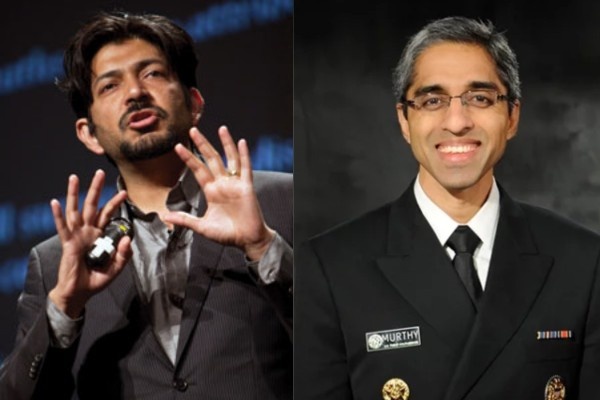

तेंदुलकर और धोनी म्यूचुअल फंड एसआईपी का विज्ञापन कर रहे हैं। / YouTube

तेंदुलकर और धोनी म्यूचुअल फंड एसआईपी का विज्ञापन कर रहे हैं। / YouTube

हाल ही में समाप्त हुई टी20 विश्व कप श्रृंखला केवल स्क्रीन पर दिखने वाले क्रिकेट के लिए ही महत्वपूर्ण नहीं थी। उसका महत्व क्रिकेट के खेल से कुछ आगे तक जाता है। सबने देखा कि कई पूर्व क्रिकेटर लगभग हर दिन मासिक निवेश योजना पर म्यूचुअल फंड करने के कुछ हद तक संदिग्ध लाभों का समर्थन कर रहे थे। यह कुछ ऐसा था जिसे हमने कई महीनों से नहीं देखा था।

इसके पीछे का एजेंडा और तथ्य यह है कि तेंदुलकर और द्रविड़ सभी एसआईपी, या म्यूचुअल फंड का उपयोग करके व्यवस्थित निवेश योजनाओं के लिए उत्साहित थे। वह सब लुभाने वाला था। लेकिन यह समझने में ज्यादा समय नहीं लगा कि भारत में सरकार लोगों को अपने स्वयं के म्यूचुअल फंड पेंशन लाभों पर काम करने के लिए प्रेरित करने को लेकर इतनी उत्सुक क्यों है।

एक समय था जब भारत में निजी उद्यम को कर्मचारी भविष्य निधि जैसी सेवाओं का उपयोग करना अनिवार्य था। उसे कर्मचारी द्वारा निवेश किए गए योगदान के बराबर योगदान देने के लिए मजबूर किया जाता था। और पूरी प्रक्रिया का सावधानीपूर्वक ऑडिट किया गया।

बहरहाल, वो दिन तो हवा हुए। अब कुछ वर्षों से वर्तमान सरकार, कम से कम वह जो कम बहुमत के साथ भारत में फिर से सत्ता में आई है, कर्मचारी भविष्य निधि संगठन का जमकर प्रचार कर रही है। कई तथाकथित कारोबारी समाचार पत्र या आर्थिक और वित्तीय साप्ताहिक इसे राष्ट्रीय पेंशन योजना के रूप में अनुशंसित करने की कोशिश कर रहे हैं।

यह समझना भी कठिन नहीं। ईपीएफओ के विपरीत, राष्ट्रीय पेंशन योजना सरकार को पेंशन के लिए एक पैसा भी खर्च करने के लिए बाध्य नहीं करती। प्रत्येक कर्मचारी को अपने जीवन का अधिकांश समय मध्य आयु से लेकर लगभग 60 वर्ष की आयु तक बचाने की आवश्यकता होती है। इसमें से एक महत्वपूर्ण राशि निकालनी होती है और इसे वृद्धावस्था पेंशन के मासिक भुगतान के बदले में प्राप्त करना होता है। यानी सरकार का कोई खर्च या योगदान नहीं। अपनी पेंशन के लिए आप ही कमाइये और आप ही बचाइये। सरकार के लिए इससे अच्छा और क्या हो सकता है।

जिस उत्साह के साथ हमारे क्रिकेट दिग्गजों ने इस योजना का समर्थन किया, उससे केवल यही पता चलता है कि सरकार के पास हासिल करने के लिए बहुत कुछ है और खोने के लिए कुछ नहीं। हां, किसी तरह यह भ्रम पैदा करना है कि यह पेंशन है।

आपको बता दें कि अधिकांश लोकतांत्रिक देशों में, विशेष रूप से उन देशों में जहां पश्चिमी यूरोप की तरह एक मजबूत समाजवादी पूर्वाग्रह है, नागरिकों के शेष सेवानिवृत्ति जीवन के लिए राज्य द्वारा नागरिकों के प्रति योगदान देना अनिवार्य है। भारत में ऐसा नहीं है। यह दक्षिणपंथ की ओर राजनीतिक झुकाव है।

तो क्या यही भविष्य है? क्या सरकार जबरदस्ती करने जा रही है. क्या लाखों नागरिकों को अपनी बचत से बुढ़ापे के लिए पैसा बचाना होगा। और यह काम पैसा देय होने से 40-50 साल पहले ही शुरू कर देना है? राजनीतिक टिप्पणीकारों ने विपक्षी दलों के बड़े प्रतिनिधित्व के सामने कुछ और जवाबदेही का सुझाव दिया है।

आनंद पार्थसारथी

आनंद पार्थसारथी

.jpg)

Comments

Start the conversation

Become a member of New India Abroad to start commenting.

Sign Up Now

Already have an account? Login