ADVERTISEMENT

Short Videos

See MoreCommunity

See MoreIndo-Canadian funds hurricane relief in Jamaica

The donation was directed to three aid groups supporting emergency response and reconstruction after Hurricane Melissa.

-

Several panelists echoed the view that Indian Americans had achieved remarkable success in business and professional fields but lagged behind...

-

The songs will feature vocalist Anuradha “Juju” Palakurthi, Mithilesh Patankar and the Budapest Scoring Orchestra conducted by Péter Illényi.

-

Singh said a rising number of Indian Americans are running for office, reflecting growing confidence and engagement in U.S. public...

ADVERTISEMENT

Videos

View AllOpinion

See MorePeople

See MoreSt. Kate’s names Anupama Pasricha to leadership integration role

Pasricha, who currently serves as dean of the School of Business, will transition to the new role effective Jan. 5, 2026.

-

The contest is organized by UK-based Varkey Foundation, in collaboration with UNESCO and GEMS Education.

-

Earlier this year, Kannan was awarded the title of Curators’ Distinguished Professor by the University of Missouri Board of Curators.

-

Gunda has served on the commission since 2021 and currently holds the position of vice chair.

ADVERTISEMENT

Entertainment

See More

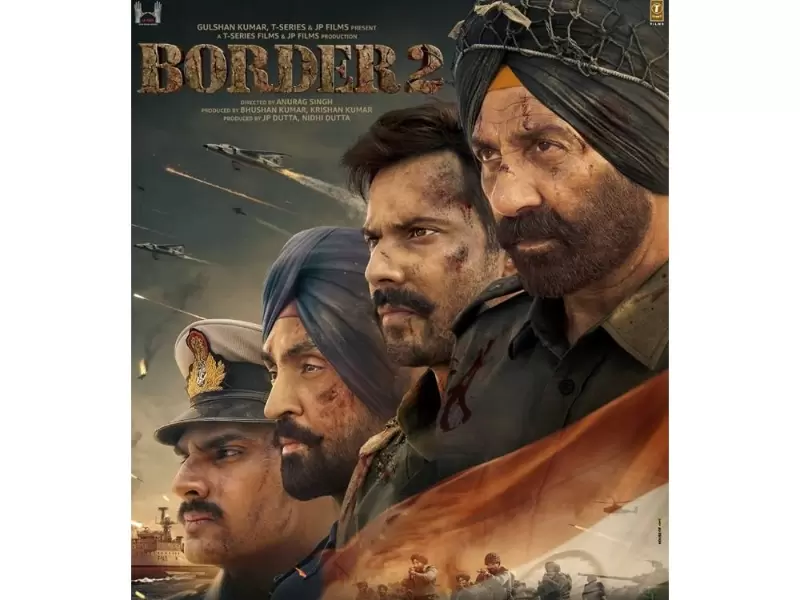

The teaser offers a commanding glimpse of the four leading men, Sunny Deol, Varun Dhawan, Diljit Dosanjh, and Ahan Shetty.

-

Michael Bay is entering the Indian film industry with his new creative collaboration with Bhanushali Studios Limited.

-

Reiner rose to acting fame as the oafish son-in-law Michael "Meathead" Stivic on groundbreaking 1970s sitcom "All in the Family,"...

-

The couple, who went public with their relationship in 2023,...

-

Irani praised Khanna’s performance in Dhurandhar, calling it a masterclass...

-

ADVERTISEMENT

Immigration

See More.png)

New policy requires public social media access for skilled workers, dependents and students starting Dec. 15.

-

Employers filing initial H-1B petitions currently pay between $960 and $7,595 in combined regulatory and statutory fees.

-

The study by Stop AAPI Hate cites rising anxiety, surveillance concerns, and inadequate institutional support across U.S. campuses.

-

The new policy eliminates self-submitted photographs, allowing only photos taken...

-

Indian professionals and their families are among those most exposed...

Food

See More-

The menu draws from Lucknow’s narrow lanes, Delhi’s Mughal-era durbars, Hyderabad’s Nizami kitchens and the coastal food cultures of Tamil...

-

ADF Foods is a fourth-generation family-owned leader in gourmet frozen

-

Attendees will receive a tour of the kitchen, observe operational processes, and participate in a live question-and-answer session.

-

The restaurant holds a 4.8 rating from more than 10,000...

-

It will replace the existing Rosedale restaurant in Jan. 2026,...

-

Khanna offered the warm drinks to guests queued outside his...

-

-

London group behind India-focused restaurants was sold as expansion plans...

SPORTS NEWS

See MoreGreen made his IPL debut in the 2023 season after...

Messi was scheduled to land in the national capital earlier...

The Indian team became fifth nation to win a major...

Left-arm quick Arshdeep returned figures of 2-13 as India bowled...

News

See More-

ADVERTISEMENT

Please enter something

- Asian Americans

- Biz

- Books

- Canada

- Community

- Culture

- Dating

- Diplomacy

- Diwali

- Editor picks

- Editorial

- Explainers

- Fashion

- Features

- Food

- Immigration

- India

- India Decides '24

- India Independence Day

- Letters to the Editor

- Life

- Maha Kumbh

- Movies+

- News

- Opinion

- People

- Ram Mandir

- Reviews

- Sports

- Spotlight

- Tech

- Travel n’ Diplomacy

- Trump 2.0

- UK Votes 2024

- US Elections 2024

- USA

- West Coast

.png)